How to plan your retirement?

In the Philippines, many people die not because there’s no medicine, but rather due to a lack of enough funds to access better healthcare.

The last year 2021, my relatives died without any savings from the bank. Most of the older generations don’t have savings when they get sick. Their kids and relatives contribute when they get hospitalized. In the case of my dad, We have emergency funds to send him to a hospital and a budget to get a private home nurse during a pandemic.

But since they are not the ones spending they feel shy and a burden. It hurts to see them feeling that way and asking me and my sister to decide for them because we will be the ones paying for it. It is weird that I don’t use to decide on things but because I am the one who has savings and my sister we have to decide. Is it true that if you have Money this is equal to Freedom?

I wish that they can just decide which hospital they want to go to without feeling a burden. This reminds me to work on my retirement, cause I don’t want our future kids to feel the same way.

As for his kids, for me, it is okay to spend because he is my dad and I cannot afford to see my father not doing any medication even though I have emergency funds in the bank. But the way they feel, I cannot change that. My mom and dad, don’t have the freedom to decide and go to the best hospital because they are too shy to ask their kids. Not all children also can afford to bring their parents to the hospital when they get sick.

I remember my dad feeling bad about his second cousins that they lacked financial support, the cousin just waited to die at home. Most of his children have their own family and their kids are their priority.

According to the World Health Organization, 48% of expenses in the household are health-related expenses due to illness.

Based on my personal survey of people aged 22 to 45 years old,

18 out of 33 people said retirement is something that they will save in the future.

While 7 out of 33 people said retirement is what they need but not their priority.

6 out of 33 people said they are already saving for their retirement and

1 out of 33 people said she is not ready to retire but her future kids will help when she gets older.

While 1 out of 33 can retire anytime.

What is really the right age to prepare for your retirement?

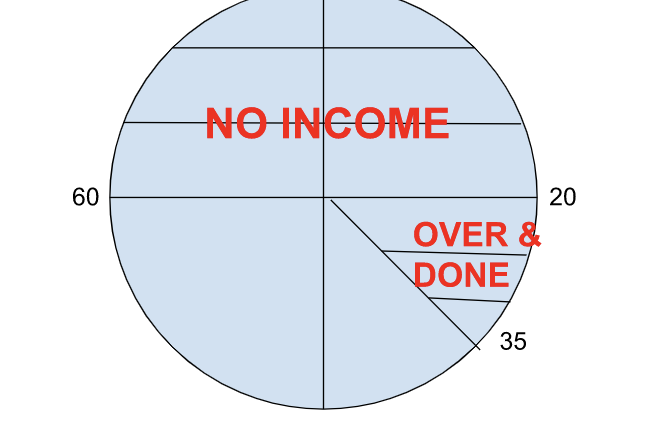

The graph below is called the 28000 presentations by Sanjay Tolani.

28,000 is the average number of days a person lives which is equal to

=76.71 years (you do the math)

Let’s assume it is approximately ~ 80 years to make life easy. Let’s break this 80 into 4 parts. Please see the graph below

0 to 20 years old is the first stage of your life, this is where you study, play, learn something new, and fool around.

20 to 40 years old, this is where you started your first job, bought your first car, bought your first house, got married, and have kids.

40 to 60 years old, we might change our job or start a business, or might have a second job. We will definitely buy a second car because It’s 20 years you are now driving a piece of junk. We might buy a second house as an investment. More importantly, our kids are now getting ready to finish their first of our life.

And then 60-80 years old, we hope to retire.

60-80 years old and 0-20 years old is the stage of our life when we don’t have income. Dr. Sanjay Tolani invented the 28,000 days if we minus half of it which is 14,000 days.

28,000 days

-14000 days

___________

14000 days

We only have 14000 days to achieve our dreams, our kids’ dreams, and our parents’ dreams. Now, if you are around the age of 35 years old this part of life is already over, you only have 25 years time left to save for your retirement.

Drawing this period of time we identify our biggest fears.

- What if I cannot work to 60? – Because if I finish working until 60 years old the only thing left is to retire, but the real thing that can stop me from working until 60 years old is the either disability or a bad illness.

- What if I don’t reach 60? – If I reach 60 the only thing left is to retire, but if I don’t reach 60 we have a problem. How will my family continue life? That is the second biggest fear and the way to handle this is if we have a lot of investments with good returns our family can use this to continue life or use a product called life insurance which is income protection for a family in the event of death if I don’t have any investments.

- How much is enough to retire? Is 1 million or 5 million enough? To know this answer, ask some financial coaches to make life easier or read financial books. But the most important thing is that only you can know how much is enough to be able to retire. What life would I like to have when I retire? From there you determine how much money you need for the life you like to have and add a 6% increase every year for the price increase due to inflation.

- Can I ensure that my children start a life with the right foundation? The best foundation is to have the right education. Again, you can ask the financial coach for consultation or determine again how much your children will need for their education.

If you noticed he covered 4 different products to help your 4 problems,

The first biggest fear is you can get a Critical Illness product or Income Protection.

The second biggest fear is whether you can get Life Insurance or find a way to invest.

The third biggest fear is that you can get the answer in this article just by reading the number three again.

The fourth biggest fear is that you can plan ahead and determine how much is the estimated amount your children need in the future by saving it or making life easier by consulting with your financial coach for an educational plan for your children.

Thousands of Pinoy Overseas workers end up retiring without enough savings for retirement. The 13th-month bonus almost always ends up being spent rather than saved or invested. Financial problems are putting stress on relationships, and credit card interest rates per month plus overspending are causing stressful debt problems to many. Overworked yet lack of savings is causing people to wonder and ask “Where did my money go?.”

In the Philippines employees and their employers are required to pay for their Social Security System who have retirement benefits. But SSS is not enough, it will not sustain your medical bills and you will need to downgrade your lifestyle if you will depend on SSS alone. Your 20 pesos then can buy 2 cupcakes and 1 soft drink. Now you can just buy candy and powder juice drinks due to inflation. That’s why 20 pesos is just a coin from the previous paper bill.

When we get older we cannot also depend on our children because they will build and take care of their own families. We cannot pass the burden to them. We will live longer imagine retiring at the age of 60 with no income than living until 80, that is 20 years’ worth of expenses. How about taking a vacation for a month with no salary is already hard for us. Get your own backup plan now and know your options.

When is the best time to plan your retirement? Only you can answer that, but for me “Prompt beats diligent.”

Leave a Reply

Want to join the discussion?Feel free to contribute!